One day, ICE will rule them all… but RCs are still the gold standard of due diligence about prospective partners in Morocco

̶h̶t̶t̶p̶s̶:̶/̶/̶s̶i̶m̶p̶l̶-̶r̶e̶c̶h̶e̶r̶c̶h̶e̶.̶t̶a̶x̶.̶g̶o̶v̶.̶m̶a̶/̶R̶e̶c̶h̶e̶r̶c̶h̶e̶E̶n̶t̶r̶e̶p̶r̶i̶s̶e̶

2023 update: the correct link is now:

https://r-entreprise.tax.gov.ma/rechercheentreprise/

Identifier une entreprise au maroc à partir de son ICE

Registre de Commerce aka RC: the who’s who of business

In many countries around the world, the Napoleonic system of registration for business ventures (“entreprises” in french) requires businesses to register with the local ‘Tribunal de Commerce’, which records and publishes:

-the purpose (l’objet) of the business,

-the name of the manager of the company and more broadly the name of who can represent the company in contracts, obligations, and compliance.

-certain types of loans/purchasing deals undertaken by the business, such as what in French is called ‘leasing’, typically used for cars (It is not clear if this kind of loan is available for other purchases).

-presumably, but not yet empirically verified, what court actions are pending against the business as well as history, if any, of court decisions against the business.

IF? TP? RC? or ICE?

In other words, it is a (more or less) freely accessible deposit to ensure that the information from say, a business card, matches formal, legal information. This may be the RC number or the filing ID with the local commercial court (tribunal de commerce). Then again, certain potential partners may require a ‘Patente’ aka ‘Taxe Professionnelle’ aka ‘TP’ identifier. As Churchill said, only two things in life are unavoidable: death and taxes. Correspondingly, an enterprise/business/venture/’personne morale’ as opposed to an individual or self-employed in English rather than French meaning, which considers self-employment as: entreprise société à responsabilité limitée à associé unique or single associate LLC in British and some American states’ legislation.

Please note definitions of words such as entreprise, business, venture, LLC, SARL, and others may vary significantly from one country to another. The terms used herein are used for illustrative or educational purposes and are not legally binding. Each venture is unique, and we can only speak to the legal environment our customers operate in Morocco. Wherever possible, we will try to provide you with the relevant French words for you to carry out your own relevant administrative or compliance procedures or at least have a better-informed position in formulating your needs to local service providers.

Back to the matter at hand,

As we saw, there were three ways of identifying a business in Morocco:

-RC or Registre de Commerce

-Patente aka ‘Taxe Professionnelle’ aka ‘TP’

-Idenfiant Fiscal aka ‘IF’

-Extremely rarely, the CNSS id,

And then came the ICE

In a long-term bid to simplify things and provide better coordination between different administrations, Morocco has introduced the ‘Identfiant Commun aux Entreprises’ aka ICE. Long term, this should be the only 24-digit number any business needs when complying with Moroccan legislation. As of 2020, we’re not there yet, but the long-term objective of having a single identifier for each business remains.

Interestingly, the recent-ish introduction of the ‘Auto-Entrepeneur’ legal status, a form of self-employment, is included in this system. Auto-entrepreneurs ’emit’ invoices that are exempt from VAT. More specifically, they are ‘exposed’ to a VAT rate of 0%, and we believe it is unlikely this rate will rise in the short term, but may well change in the short term as the current setup does not provide ‘auto-entrepreneurs’ with nationally mutualised health care (aka socialism if you’ll pardon our crude language). In time, the obvious advantages of allowing an ever-growing population of single-person-ventures-which-can-provide-invoices to contribute to the national health insurance scheme: after all, regardless of how the money goes out, why should people who want to pay into the system be discouraged?

Invoicing in Morocco requires two ICEs

in Morocco, ANY invoice has to mention the ICE of the company emitting the invoice (émettre une facture) AND the company to whom the invoice is sent (le récipiendaire).

If we were not clear enough, please consider invoices not bearing both ICEs are not legal and can incur extremely heavy fines and prison time.

Forewarned is forearmed: Do not mess with this and expect to stay mid-to-long term in Morocco.

So, two questions remain: What’s your ICE? What’s theirs?

Who’s who in business in Morocco

Publicly accessible information about companies in Morocco

̶h̶t̶t̶p̶s̶:̶/̶/̶s̶i̶m̶p̶l̶-̶r̶e̶c̶h̶e̶r̶c̶h̶e̶.̶t̶a̶x̶.̶g̶o̶v̶.̶m̶a̶/̶R̶e̶c̶h̶e̶r̶c̶h̶e̶E̶n̶t̶r̶e̶p̶r̶i̶s̶e̶

2023 update: the correct link is now:

https://r-entreprise.tax.gov.ma/rechercheentreprise/

This government website provides you with all information legally and publicly available about companies, specifically their purpose, authorised representatives, and contact information.

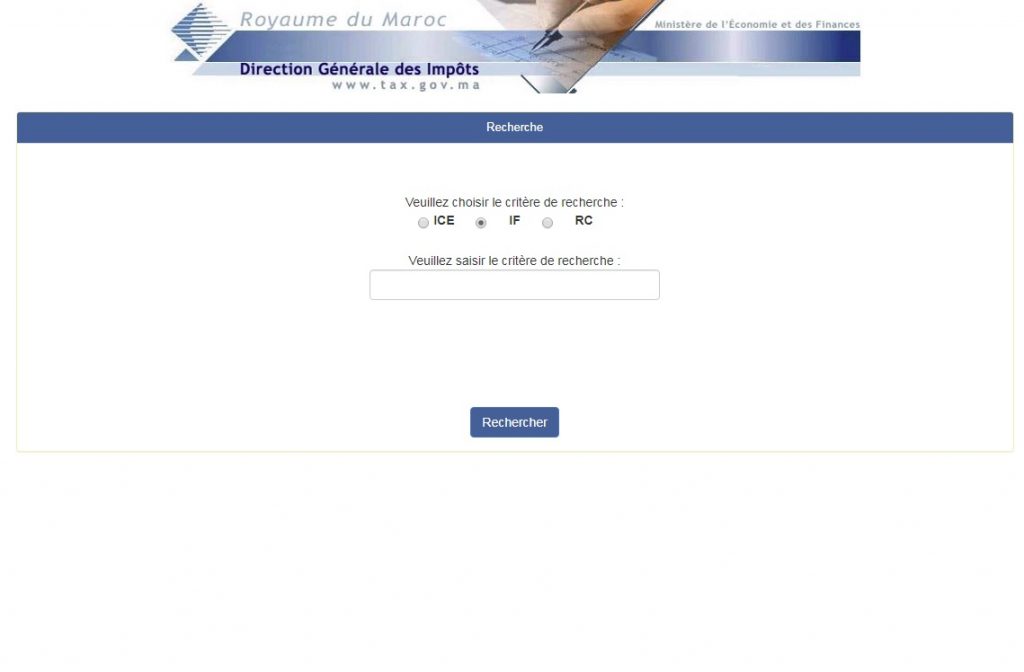

First select which of three possible identifiers you would like to search for: the ICE, the IF, or the RC; then input the relevant id number.

In effect, this barebones database can confirm whether or not a given company, as identified by ICE,IF or RC, exists or not.

For more in-depth information about a company/business/’personne morale’ registered in Morocco, the RC remains of particular interest as it provides, online only, for a fee of 20Dh payable with any Morocco-issued Visa or Mastercard, information about existing liens and credit liabilities. Please see our separate and upcoming article on ‘Exploring the Registre du Commerce’ for more information on due diligence in Morocco.

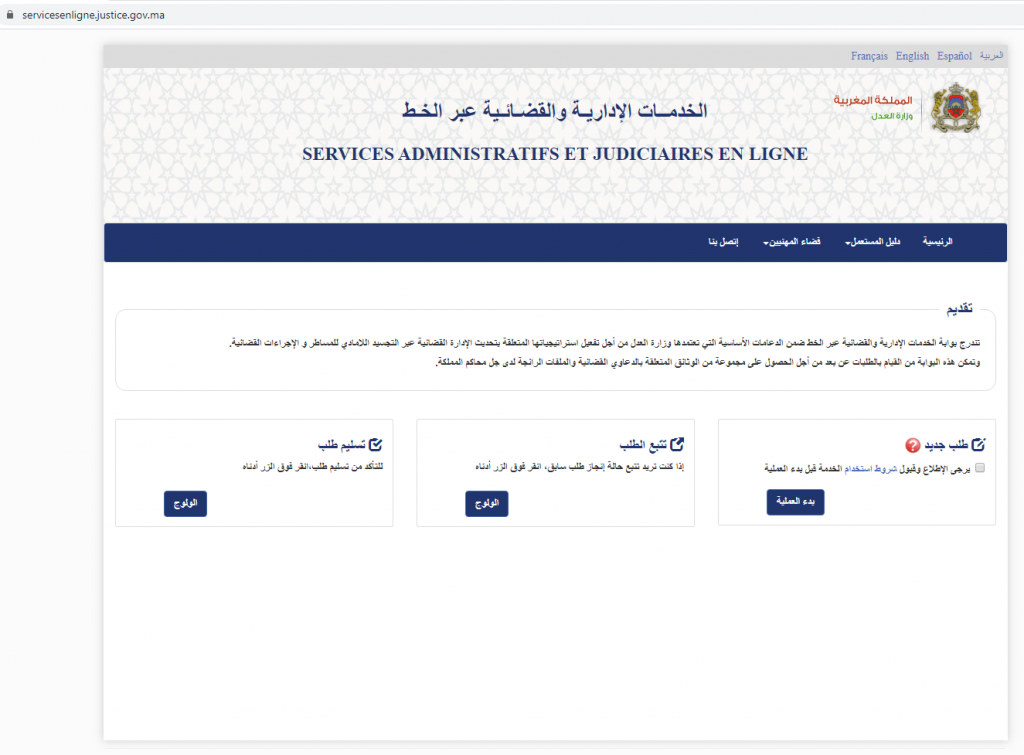

This online portal provides, for a fee of Dh20, information publically available about a given registered company, including legal representatives, some liens such as ‘vehicle leasing’ loans and (presumably) sentences against it.

A disappointingly translated version is available in English, we suggest sticking to the French version if you can. We are currently compiling a ‘who-is-this-Registre-du-Commerce’ guide in English, so watch this space.

The ‘Model J’ issued by the Registre de Commerce is required for any legally binding contract or agreement with a public institution undertaken by a company representative: The ‘Modele J’ available only online, and costs 20Dh. Please bear in mind your request will probably take at least 24 hours to process, but the Dh20 fee can definitely be paid with a Morocco-issued Visa or Mastercard.

https://servicesenligne.justice.gov.ma/

Bear in mind that the model J on the website is actually called “Modèle 7”

Please note you will have to provide Moroccan or international Visa or Master card details to pay the 20Dh fee. As of early 2020, the payment interface is only available in Arabic, which is manageable as long as you stick to the standard card number/name/CVV number routine.

2 comments on “Identifiant Fiscal (IF)? Patente? Registre du Commerce?”